Right now you could say that the inflight entertainment industry is a bit like boxing.

Plenty of interested parties – financial institutions included – tune in when deep-pocketed heavyweight contenders like Panasonic, Thales, Zodiac, Gogo and Global Eagle Entertainment duke it out for the prestigious titles. These guys are well-conditioned with plenty of victories under their belts. They possess patience, endurance, control and deep enough pockets that, time and again, see them land the killer punch.

At the same time however, in a smaller IFE ring and away from the spotlight, scrappy, hungry lightweight upstarts are facing off in fast-paced contests where the focus is more about a value proposition for regional and budget airlines than market leadership with Tier 1 and 2 carriers, or indeed flashy tech. They are literally giving it all they’ve got to win one small airline customer at a time.

Independently-backed IFE streaming providers are surfacing at an unprecedented rate in commercial aviation. Designed for a quick deployment and typically proposing near immediate revenue-generation (via sponsored content and creative third-party advertising programs), most of these new systems are being offered to airlines for free or at a fraction of cost of wireless systems from the majors.

For some of these companies, the bell will ring before they even get to tap gloves.

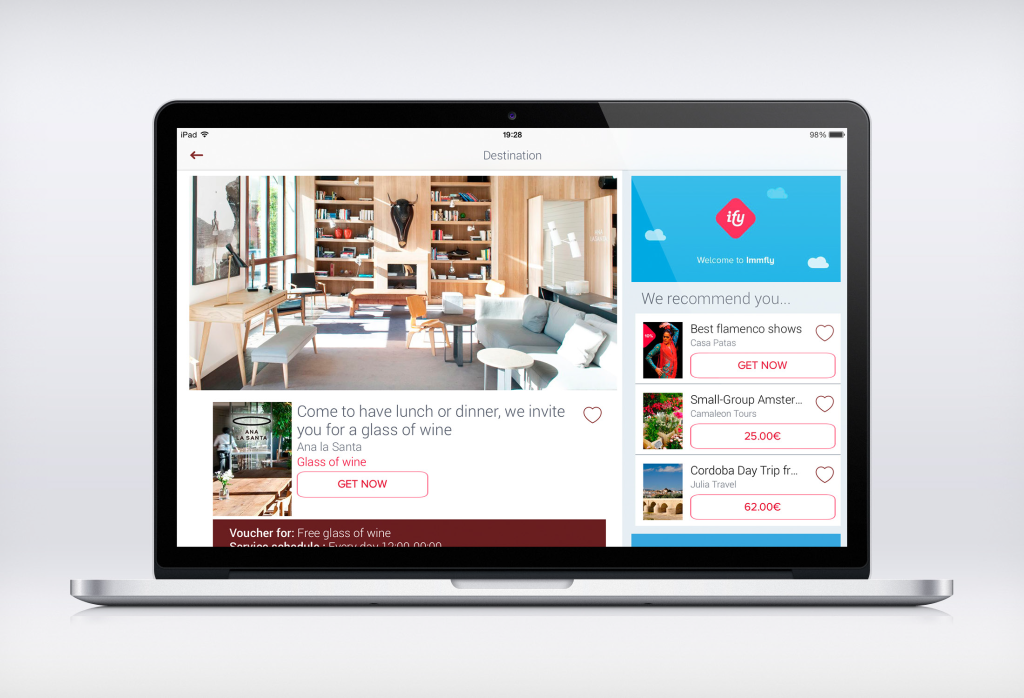

Jimmy Martínez von Korff is one of two young entrepreneurs who founded Immfly, a Barcelona-based streaming solution that won Iberia Express as a customer within its first year of operation. He estimates around 98 percent of regional aircraft in the EU to be without any sort of IFE or connectivity solution and believes that his firm can snag 15 percent of that overall market (or about 1000 aircraft installed) by 2018.

“Immfly was founded by technology, advertising, media and e-commerce professionals,” he says. “We saw a very interesting opportunity in short to mid-distance flights because of the captive audience and because the aircraft in these routes do up to seven flights per day. That means that if you install something in one aircraft you can reach 700 or 800 people per day, per aircraft.”

This audience – wealthy enough to fly and bored silly in metal tubes that generally don’t yet offer inflight connectivity – is one that many retailers are keen to access. Immfly easily recruited a host of brands to sponsor content and advertise on Iberia Express’ IFE, which helped to seriously reduce investment overhead.

Martínez von Korff is well aware that Immfly is not the only start-up targeting the regional and low-cost sector with such a business case. “New players are coming every three months,” he says. “We analysed about 15 potential competitors six months ago and today we are watching something like 24.”

Undoubtedly, UGO by Display Interactive of France is one of the 24 that Immfly has been observing. Launched at Aircraft Interiors Expo in 2014, the UGO system uses Kontron open source hardware (shipped with Linux), which also forms the basis of Airbus KID Systeme’s SKYfi offering and Lufthansa Systems’ BoardConnect system, the latter of which has been fitted to Virgin Australia’s entire narrowbody fleet (currently 93 aircraft); is being fitted to El Al’s 737 and 767 fleets; has been added to an initial 20 Lufthansa narrowbodies, and has debuted on an Air Calin aircraft.

Thierry Carmes, strategy and development director at Display Interactive, agrees he faces intense competition from both well-established providers and start-ups. Naturally, he thinks that UGO (which says it will announce a first customer in the next month or so) is better-positioned than most to actually make it.

“In this field you want to be as close as possible to your clients. You need to be flexible and agile and I think this is one of our key advantages,” he told RGN, adding that being flexible and hip to consumer patterns alone is not enough to guarantee success. “There are also some major rules in this business. There is certification and safety, you need to understand how the market works. Some of our competitors are not so experienced here and might face a lot of difficulties in coming months or years.”

Display interactive touts a “less than three day” installation time per aircraft for UGO. This is better than embedded IFE by miles, but not great. Three days on the ground for an aircraft that might normally carry 700 passengers per day is a lot of lost revenue, no matter which way you slice it.

Two suppliers that we know of (and there could well be others) have found a loophole allowing them to avoid lengthy and expensive certifications while reducing aircraft downtime to naught. Media in Motion (MiM) out of the UK (which has a common shareholder with Retail inMotion, a company that airline catering giant LSG Sky Chefs owns 40% of) and AirFi in Holland have both developed systems that run on battery power and are compact enough to be “stowed” rather than “installed” on the aircraft, eliminating a slew of regularity hassles.

The AirFi solution has been adopted by Estonian Airlines and the shoebox-sized box forms the basis for a new airport-to-airport “IFE” experience being rolled out on Arkefly, charter carrier of TUI Group’s Dutch tourism arm. Beginning in July, the boxes will be deployed at Arkefly’s two main logistical bases of Amsterdam Schiphol and Eindhoven Airport in the Netherlands, as well as at 15 of its international destination airports (tucked away near airline check-in counters and at departure gates), and enabling the airline to stream a variety of games and content to passengers’ own personal electronic devices. Tying the experience together, AirFi boxes on board Arkefly’s fleet (five Boeing 737s, two Boeing 767s and three Boeing 787s) will stream IFE content to guest’s mobile devices throughout their flight. Upon landing at the destination airport, another AirFi Ground network will allow guests to download destination-specific information and guides, or discover where to find their ground transport – while waiting for their bags to appear on the carousel.

MiM’s portable solution, also based on a retail model, has attracted two airline customers, including Monarch, to date. MiM also has a more robust installed system with three customers.

“Each year there’s been a crop of newbies,” says Martin Cunnison, CEO of MiM. “Storebox and Ocleen recently appeared but have since vanished. One called WAvES is new this year. It’s an attractive business to start-ups because it’s pretty simple to make a nice-looking website or app and embed some streaming technologies… so you can produce a great demo relatively cheaply. Adding DRM & PCI compliance and getting installations done under STC are all difficult, time consuming and expensive, so I think that’s why fewer break through into a real deployment.”

Cunnison notes that 60 companies have announced entry to market since he started tracking in 2012. Ten of them have disappeared and five have been consumed or consolidated into larger groups – a strategy that he says is often necessary to avoid the dreaded knockout punch.

“For the airline, a risk adverse buyer, buying an unknown product from an unknown vendor is an unattractive proposition,” he says. “There’s an adage in our industry: No one gets fired for buying Panasonic.”