The successful launch of an Intelsat satellite from French Guiana spells good news for Ku-band airborne communications providers Panasonic Avionics, Gogo and Global Eagle Entertainment, which use Intelsat’s global Ku broadband mobility infrastructure to keep airline passengers and crew connected in-flight.

Intelsat 34 – a C- and Ku-band satellite – lifted off early yesterday morning on an Ariane 5 vehicle. Among its payloads, the satellite is carrying a specialized Ku payload that will support broadband services over the North Atlantic for the fast growing aeronautical mobility sector (and for maritime). American Airlines, Delta Air Lines, Icelandair and Lufthansa are among the carriers offering Ku satellite-supported connectivity on North Atlantic routes.

Intelsat CEO Stephen Spengler says Intelsat 34 “is a great example of the breadth of services that Intelsat’s satellites are able to provide to communities around the world”. But those services extend beyond operating its own satellite network.

To wit, Intelsat recently signed an exclusive agreement with antenna maker Phasor Solutions to co-design and produce a low profile, active phased array Ku antenna that will be optimized for Intelsat’s forthcoming Epic High Throughput Satellite (HTS) platform and sold to government and civil aviation customers. The first Epic satellite – Intelsat 29e – is slated to launch in the first quarter of 2016.

Phasor currently has a very defined relationship with Intelsat insofar as the agreement covers antennas “just for Ku and just for small jets”, Phasor CEO David Helfgott tells RGN. “Our primary focus [in aero] is on the unserved and underserved general aviation market,” he says. However, the antenna “could easily be expanded” to the commercial regional jet (RJ) market.

In North America, Gogo is the dominant provider of inflight connectivity to the business aviation community and on RJs, with thousands of smaller aircraft fitted with its air-to-ground system. Would Gogo consider a possible partnership involving Phasor’s Ku antenna hardware, especially as its ATG network grows ever more congested? Gogo CTO Anand Chari isn’t saying, telling RGN only that the firm has a variety of NDAs in place with antenna providers.

Helfgott also sees opportunities for ultimately bringing Phasor’s antenna hardware to large jets. “These panels can be connected to any scale, because they don’t lose quality [so yes to the 777 or A380 even]; you could get very large active array,” he says. Phasor has already modeled a large commercial aircraft antenna “that could do 100 Mbps in and 20 Mbps off, but that’s the antenna design”, adds the Phasor executive.

While Phasor is also targeting maritime and land-mobile (trains, trucks, etc) for its technology, cracking into the aero market “is the most difficult”, he notes, “because of the licensing and type approval and airframe-based qualifications required for aero”. The technology is expected to be commercially available around the 2018 timeframe.

Intelsat, meanwhile, has a separate arrangement with Phasor rival Kymeta which entails offering Kymeta flat panel antennas to the automotive industry; nothing for aero. These antenna deals, coupled with Epic’s “growth story” and Intelsat’s new strategic alliance with OneWeb to ensure its aeronautical and maritime customers will be able to use the planned OneWeb low-orbit satellites when needed, represent “smart moves” on the part of management and positions Intelsat for future growth, according to Raymond James analyst Chris Quilty.

The OneWeb arrangement, in particular, is “pretty straightforward”, explains Intelsat SVP, global sales and marketing Kurt Riegelman.

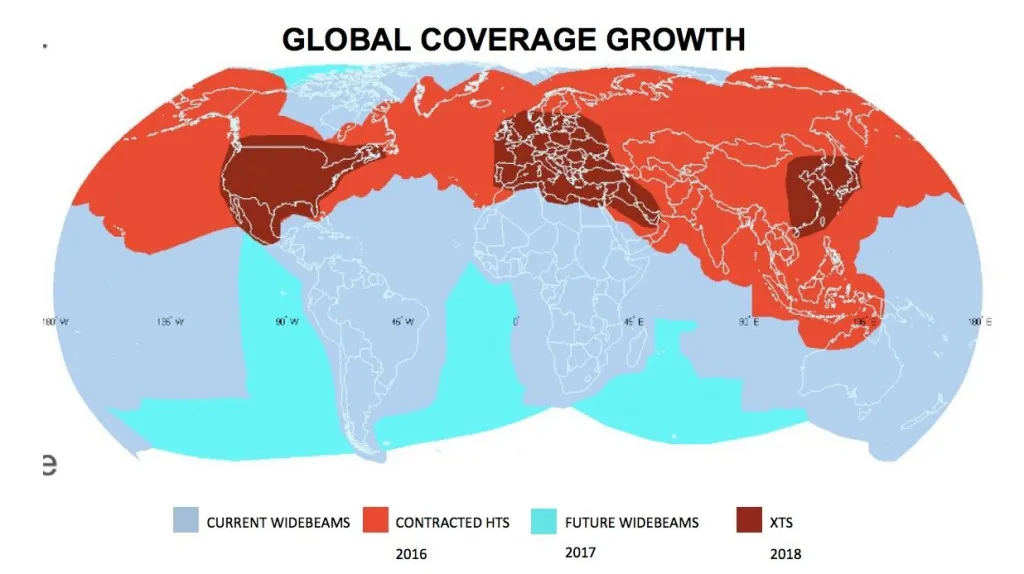

“I think for ourselves, obviously Intelsat provides Ku widebeam coverage and soon with the launch Intelsat IS-29e the first Epic HTS and that global fabric is the cornerstone of what we see in providing to the aeronautical business going forward. Between cockpit and consumer, we see this business growing a lot. There is a core mission for OneWeb, which is to provide broadbeam on the ground, but there are a lot of places we think we can take this technology – and through our service providers – so we’ll be bundling this up with the services we have today. OneWeb is Ku-based … If there are [aero or maritime] routes growing beyond what we can handle at the time, we can tap into OneWeb, or for new routes, we can tap into OneWeb,” he tells RGN.

“It’s a Ku-band overlay we believe we can integrate with, so its gives us the flexibility and freedom we didn’t have before, and as you start to head towards the poles and higher elevation – we’re soft around the poles – that’s where we can integrate. So we do see it that way as a very complementary service to our core capability. So we need to make it interoperate with Intelsat services. Let’s not fool anybody here. There is a lot of work to do in terms of development. We see streams of engagement with OneWeb; we need to work with them, we can offer assistance with satellite launch plans [if need be] but also need an interoperable terminal that can move from FSS, GEO and LEO, to offer a unique service capability. We have an exclusivity [arrangement] for distributing OneWeb’s services in certain markets – aero, maritime, US government and intelligence communicates and certain exclusivity rights in oil and gas – and we understand where the [OneWeb] partners are going. Ku was the right frequency for us and so for us, that seems to be the right fit.”

OneWeb has selected Rockwell Collins to exclusively develop and provide terminals for OneWeb’s aviation service. But are there areas where Intelsat can play beyond service and interoperability – opportunities that would involve its flat antenna partners Phasor (and perhaps even Kymeta)?

“Phasor with business jets is an opportunity for us. We can push out into those new verticals with a strong service offering. We’ll come back and look at that terminal … I think anything in that band, the question will be – what is the right long-term solution and what do we see in terms of cockpit requirements. If that data package comes out of there and gets large for virtual black box it might evolve out of the capabilities of those networks, [we] might catch it. I think it will be a great competition down the road,” says Riegelman.

“As to OneWeb, for us it provides an incremental enhancement that we think adds to our differentiation and again, it’s about rapid reaction and serving different parts of the globe with optimal capacity and there is a lot of work to do through 2019; to dig in with OneWeb and get it done. We think they’ve got the right rights and a great plan and are fully committed to getting this system off the ground.”

“With Epic, meanwhile, we’re very proud of Epic, and months away from launch of the first one,” he adds. It can’t come soon enough; capacity requirements from in-flight passenger traffic alone is expected to skyrocket in the coming years.