The votes have been tallied and the #Brexit die is cast. Even as uncertainty over the impact of the UK’s decision to depart the EU remains high, members of the aviation world are starting to weigh in with their expectations. And, much like opinions regarding the vote in general, the business world has widely varying views.

International Airlines Group (IAG), the parent company of British Airways, faces a two-pronged challenge to its operations. In the immediate short-term, the company faces currency pressures; the Pound dropped to a 30-year low against the US Dollar overnight before recovering slightly. It also dropped significantly against the Euro, Yen and other global currencies. Longer term, there are questions about the viability of the financial industry in London, a group representing a significant portion of BA’s higher-yield traffic. Losing those jobs in London would have a major impact on the airline.

IAG says the vote to leave the EU “will not have a long-term material impact on its business”. It is unclear what that long-term window is, or how much IAG expects to recover by increasing operations elsewhere in the EU, such as building out Dublin as a more significant connecting hub through its Aer Lingus operation there. IAG shares dropped more than 25% on extremely high trading volume Friday after the vote results were announced.

IAG says the vote to leave the EU “will not have a long-term material impact on its business”. It is unclear what that long-term window is, or how much IAG expects to recover by increasing operations elsewhere in the EU, such as building out Dublin as a more significant connecting hub through its Aer Lingus operation there. IAG shares dropped more than 25% on extremely high trading volume Friday after the vote results were announced.

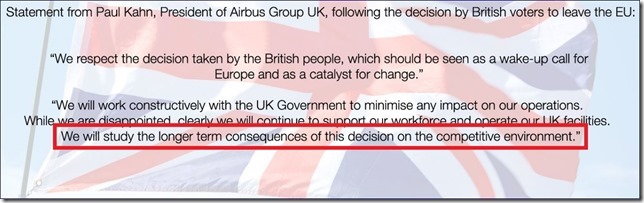

For its part, the Airbus Group maintains significant operations in the UK, including support and engineering operations in Filton and the A350 wing assembly facility in Broughton.

Paul Kahn, president of Airbus Group UK, issued a statement expressing disappointment with the vote and continued support for the operations, at least in the immediate near term. The statement closes with a more ominous view, however, as Airbus “will study the longer term consequences of this decision on the competitive market”.

Clearly there is a need for economic agreements similar to those in place while the UK is still a member of the EU in order to ensure the long-term economic viability of those operations. Moving the facility and training thousands of new workers would not be easy, but without the economic equality there could be significant risk afoot.

Finally, IATA has weighed in, offering data to support its pessimistic views. The industry trade group expects to see a significant drop in total passenger numbers – some 3-5% – for the UK in the next three years. The lower passenger count will be fed by a combination of dropping GDP and currency pressures. Passenger volume inbound and outbound, when even, typically covers imbalances in currency. For the UK, however, outbound traffic is roughly double that of inbound, IATA data show. Accordingly, the impact of the currency position, estimated at 10-15% lower than had the UK remained in, is expected to be significant and remain long-term rather than a one-time hit.

From a regulatory perspective the challenges could be even greater, with particular impact on British Airways. Air travel to the EU represents 49% of passengers and 54% of scheduled flights, according to IATA. Access to those markets is granted under the European Common Aviation Area. Leaving the EU severs those ties. The US-UK market faces similar challenges with the 2008 Open Skies treaty replacing the highly restrictive Bermuda II deal. IATA is blunt about the risks on this front:

Depending on the terms of exit, these horizontal agreements would potentially cease to apply to the UK, possibly requiring the UK to negotiate a whole raft of separate bilateral agreements.

In theory, this could be a positive in some cases, giving the UK greater flexibility to negotiate agreements suited to the best interests of UK consumers. However, as a single country the UK would lack the bargaining power of a 500-million population trading bloc such as the EU.

It is possible that the UK could remain a member of the ECAA similar to Iceland and Norway. That would require accepting EU rules on all facets of aviation, the type of outside influence its departure from the EU was supposed to remove.

It is too soon to know for certain what comes of the Brexit move. But all indications are negative for the aviation community in the UK. At this point most discussion centers on just how bad will it be and for how long.